Prices

Show / Event

Venue

Experience

No result. Clear filters or select a larger calendar range.

No show today.

Sharing, education, and creation are the three main aspects of the Paris Opera Academy's mission. With Vocational Training at one end of its spectrum and Artistic Education at the other one, the Academy strives to support young artists in learning their trades and allows students from kindergarten to university to actively discover the world of opera and ballet.

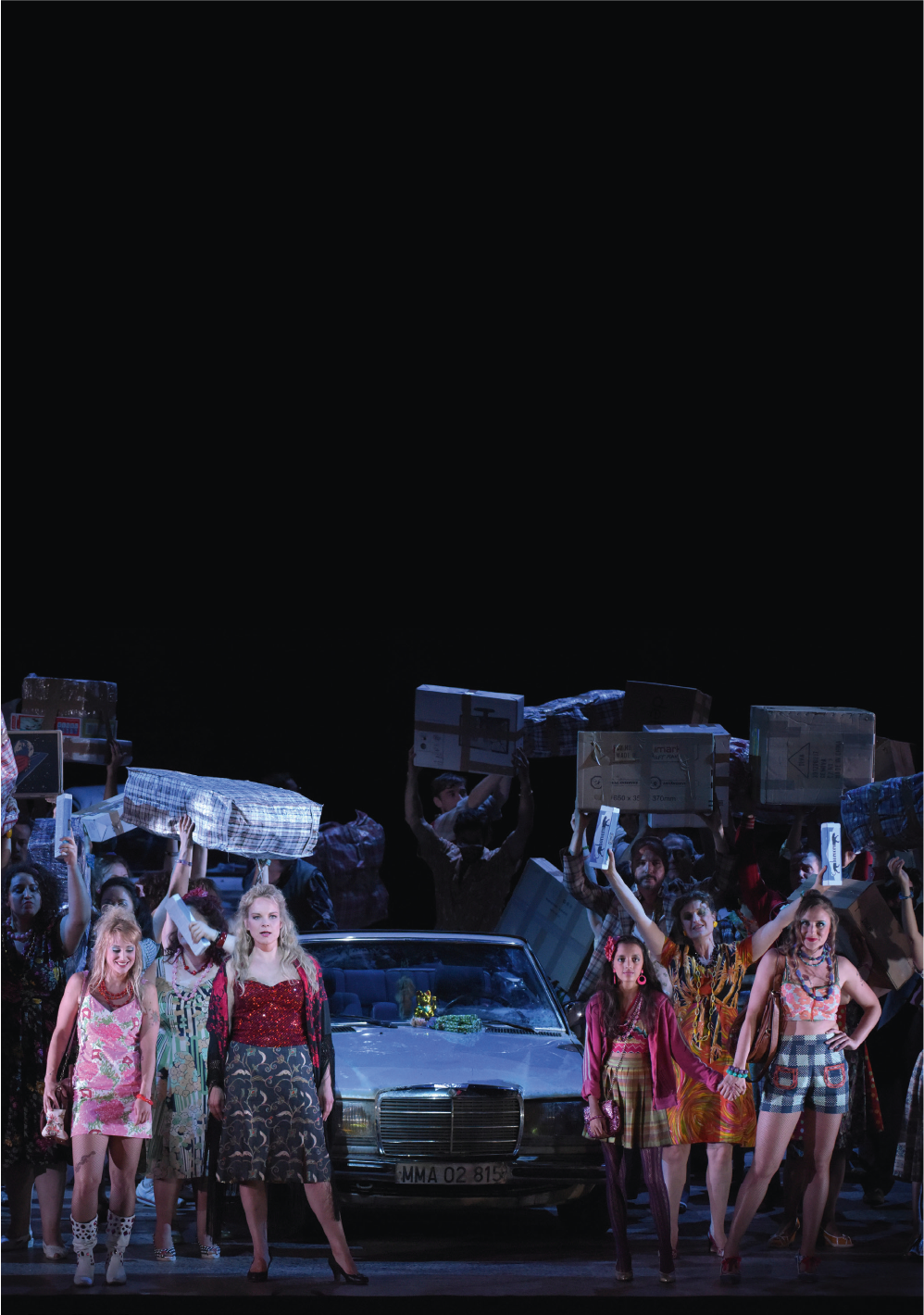

Directors and choreographers from very different backgrounds are invited to offer a new interpretation of pieces from the repertoire, both for artists in residence and for students, as part of their artistic and cultural education journey.

With its programming for young audiences, each season the Academy opens its doors to nearly 20,000 spectators of all ages. With guidance for teachers and personnel from the Opera, young audiences are introduced to the art of opera and ballet.

Diverse educational programs offered by the Academy are grouped around three areas of discovery: professions are explored through meetings with artists and professionals from the Opera, pieces from the repertoire are introduced through access to performances, rehearsals or recordings, and venues are presented as part of visits to theaters and behind-the-scenes experiences.

28

artists in residence

2

opera productions

7

concerts and recitals at the

Olivier Messiaen Amphitheater

20,000

participants in our artistic and

cultural education programming

17,000

spectators attending performances

through the Young Audiences program

You can support this project from €5 on this page.

You can also support this project by joining the Cercle Berlioz, from €15,000 (learn more).

Your donations to the Opéra national de Paris are tax-deductible.

66% tax reduction on your income tax (Impôt sur le Revenu - IRPP) :

In accordance with the provisions of the law of August 1, 2003, donors subject to income tax in France are eligible for a tax reduction on their income tax (IRPP) of 66% of the amount of their donation, up to an annual limit of 20% of taxable income. If the 20% limit is exceeded, the reduction can be carried over to the following five years.

Organizations entitled to this benefit:

Arop (Association pour le Rayonnement de l’Opéra national de Paris)

FRONP (Fondation pour le Rayonnement de l’Opéra national de Paris)

75% tax reduction on Property Wealth Tax (Impôt sur la Fortune Immobilière - IFI):

In accordance with the 2018 Finance Bill, donors taxable in France can benefit from a tax reduction on the Impôt sur la Fortune Immobilière (IFI) of 75% of the amount of their donation up to an annual limit of €50,000.

Organization entitled to this benefit:

FRONP (Fondation pour le Rayonnement de l’Opéra national de Paris)

If you are a foreign taxable donor, click here to find out more.

Immerse in the Paris Opera universe

Business Space

Back to top